The use of AI in the financial industry

According to a report on the use of artificial intelligence in the BFSI sector[1] (banking, financial services, insurance) the value of this market area was estimated at $2.5 billion in 2017. Forecasts show that by 2024 it can reach up to $25 billion. Companies in the area of broadly defined financial services invest in solutions using artificial intelligence that allow them to increase their profits by building an attractive and competitive offer, as well as optimize processes. In this article I would like to talk about why artificial intelligence has become so popular over the last few decades and demonstrate in which areas it can be used in the financial industry.

AI, why now?

The term “artificial intelligence” was first coined in 1956 by John McCarthy, who defined it as “the science and engineering of making intelligent machines”. A little over 40 years have passed since the definition of artificial intelligence until we began to actively use it to solve puzzles, and over time, tackle business problems. In 1997, multiple world chess champion Garry Kasparov was beaten by a computer. This moment sparked many discussions about artificial intelligence and its possible applications began to appear. A little over 20 years later, in 2019, the DeepCubeA neural network[2] assembled a rubik’s cube in 1.2 s, performing this task three times faster than the best people in this field. This was proof of how much artificial intelligence algorithms have developed over the past years and an example of the possibilities that AI offers in terms of process optimization.

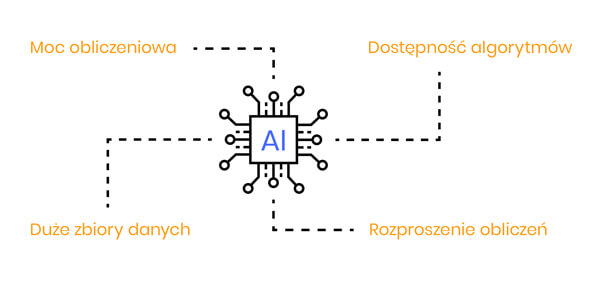

Nowadays, artificial intelligence algorithms are used to solve an increasing number of problems in various areas of our lives, from image recognition to autonomous driving. In recent years, we have observed a growing interest in this topic by companies from many industries. However, since this term has been known for almost 70 years, why is it only now that we are dealing with such huge progress in this area? There are several reasons:

- Computing power: The performance of the equipment we currently have allows us to make the calculations needed to train artificial intelligence models in a reasonable amount of time. Depending on the problem, this usually means either a few hours or several days. Another important factor is that even if the computing power of the computers we have at our disposal turns out to be too low in relation to the requirements, it is possible to rent the computing power on external servers.

- Large data sets: Another factor that influenced the popularization of artificial intelligence algorithms is access to large data sets necessary to properly tune the parameters of the models used.

- Availability of algorithms: It is also important that we received access to algorithms trained on huge data sets by companies, such as Google or Facebook, which can be used to solve our own problems. To do so we can simply train them on our own data.

The use of artificial intelligence algorithms in banking

The financial industry is characterized by access to huge data sets. The use of algorithms in the field of artificial intelligence allows to create solutions that will determine the company’s competitiveness on the market, as well optimize processes.

What solutions exactly? Here are some ideas:

a. recommendation system

Recommending the right products to current or potential customers based on an analysis of their behavior is a very important element of sales and up-selling for many companies, including banks. In addition to obvious financial gains, it also entails the potential satisfaction of customers who do not feel overwhelmed with random product advertisements, but are treated on an individual basis.

A great example of how personalization plays a big role in gaining customers and their trust is Netflix. Netflix machine learning algorithms, based on the available information, not only offer us titles that we will potentially want to watch, but also select movie trailers and series that we see on the main page immediately after logging in. If our profile shows that we like movies with Henry Cavil, the system will probably propose us the series he stars in, and on the main page we will see it’s trailer[3].

Similarly, in the banking industry, proposing the right products can be based on a range of information, such as the consumer behavioral profile or information about the products we have on offer.

b. personal assistant

Another example of applying artificial intelligence algorithms to solutions that improve the bank’s work, but also reinforce a positive opinion among customers, is a chatbot, or in a more extensive version, a personal assistant. The advantage of this type of systems is their 24-hour availability and immediate answers to questions that are frequently asked by clients. This gives a number of benefits, of which the most important are:

- growing customer satisfaction, as the need to hold on the phone to contact helpdesk is reduced

- relieving consultants who can now handle more unusual problems and answer more complex questions

In addition, in this solution it is possible to offer the customer the best offers for him in the context of his preferences and habits, as well as help in managing his home budget, e.g. by searching and sending information about subscriptions, which he may have forgotten.

c. support of stock market operations

Another example of the use of algorithms in the context of the financial sector is support for stock market decision making. Every investor faces a number of factors that influence the price of shares and future profits before making a decision on an investment.

Artificial intelligence algorithms allow you to shorten the monitoring time of these factors, which are sometimes measured in the hundreds. They also indicate information relevant from the point of view of the potential actions that we want to take.

Properly prepared solutions enable recognition of patterns present on the market, as well as forecasting prices of shares that interest us.

d. risk estimation

In the financial industry, one of the most important factors directly translating into amount of owned capital is the appropriate assessment of various types of risks, such as:

- credit risk

- market risk

- operational risk

- financial liquidity risk

In this area, it is also possible to utilize artificial intelligence algorithms that will help us. We can make estimations on the potential risk of entering a financial cooperation or granting a loan, based on customer data such as financial history or creditworthiness. It is worth adding here that in this case it is also possible to use various types of alternative data, such as: regularity in making payments that are not included in the financial history or publicly available data from social media, which build the credibility of a potential client or colleague. In this case, it is also important that our decisions are transparent, therefore it is necessary to use interpretable models. The use of this type of models when assessing things such as creditworthiness positively affects the building of customer confidence in the company, because the decisions are fair, do not depend on human interpretation and are fully verifiable.

e. detecting fraud and scam attempts

The detection of potential fraud or financial scams is another key area in which the use of artificial intelligence algorithms should be considered. In this case, as in the case of risk estimation, any wrong decision generates large financial losses and disturbes customer confidence in the brand. Here, it is also very important to create a profile of typical client behavior based on his financial history. On this basis, it is possible to distinguish bank operations performed by customers from those generated by bots or to detect suspicious activity on the customer’s account based on his personal profile and habits.

Summary

The examples presented above are just a brief description. They do not exhaust the list of possible uses of artificial intelligence in the financial industry, but they give a good reference point. This topic is very broad, and therefore one article is not enough to show the full possibilities of artificial intelligence algorithms in the context of the financial industry. For this reason, we plan to publish another article in which my teammate will talk about specific cases and projects that we had the opportunity to implement for clients in this area. Everyone interested is invited to follow our entries on our Isolution blog and our company profiles on LI and FB.

[1] https://www.gminsights.com/industry-analysis/artificial-intelligence-ai-in-bfsi-market

[2] https://www.theregister.co.uk/2019/07/16/ai_rubiks_cube/

[3] https://netflixtechblog.com/artwork-personalization-c589f074ad76