Supporting sales and handling of insurance claims using AI

Introduction

The insurance industry offers a very wide range of products, such as individual, group, vehicle insurance and many more. Each of these require compliance with different procedures, and legal requirements and the analysis of various types of information both when selling the policies and when paying out due claims.

This generates many processes that take a lot of time to handle manually. Hence the growing interest in this industry in the use of artificial intelligence algorithms.

Even a partial automation of the processes handled in the company can significantly reduce the time spent working on a single insurance offer. It will also allow for optimizing the policies parameters and reduce costs resulting from possible claims.

In this article, I would like to present a few areas in which artificial intelligence algorithms can be implemented, and the example results we were able to achieve in some of them.

Using artificial intelligence algorithms in insurance

- analysis of the degree of car damage based on a photo

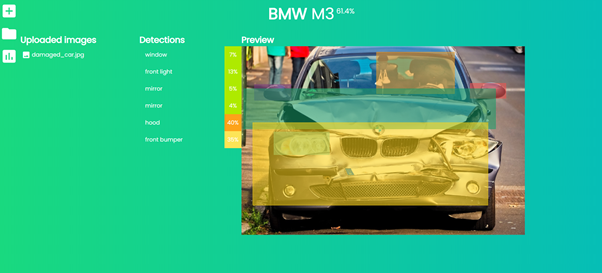

In the case of vehicle damage, determining the amount paid under the insurance requires an analysis of the degree of damage to each part of the car. Often the appraiser will make an assessment based on the photos of the individual parts of the car. Then, on this basis, the amount to be paid out is estimated.

The use of image analysis algorithms and artificial intelligence can assist the appraiser in the process of assessing the degree of damage to specific parts of the car.

The Proof of Concept application that we created with our team lets you identify and mark specific parts of the car in the photos and assign an estimated degree of damage to each of them. Some additional features available from the application level could be: finding the nearest service point, calling a tow truck or finding a replacement car.

- a system supporting the creation of an insurance offer

Creating insurance offers for new clients requires the analysis of many factors. For group insurance, these are, for example: the structure of people employed in the company, the business profile, the region in which the company is based.

In addition, the seller must follow a set of rules when constructing such offers so that they are both beneficial to the company and attractive to the customer.

In this case, artificial intelligence can be used as a recommendation system that will help the seller choose the right options for a given customer. Such a solution would allow for a significant acceleration and facilitation of work required in preparing the offer.

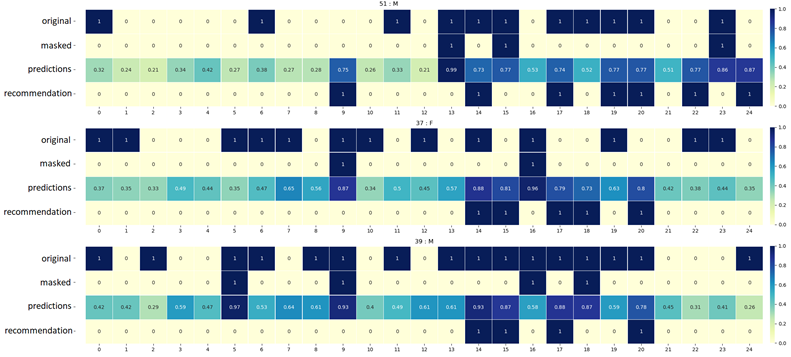

Below are examples of recommendations made by the system when we know the age and gender of the customer (51-year-old man, 37-year-old woman, 39-year-old man). In this solution, the seller selects several options (row: masked), and on this basis, the system proposes others that should be included in the policy (row: recommendation).

The first row in each group represents the original policy that was accepted by the customer.

Additionally, based on historical data presenting which policies were accepted by the customers and which were denied, he could make even better choices on the proposed offers, thus increasing the sales effectiveness of new policies.

- a system supporting the process of renewing or changing the terms of the policy

Changes to the terms of an insurance policy are most often proposed when the end date of the current agreement is approaching or when something bad is happening with regards to the policy (unexpected surge of events generating greater than predicted compensation payments). In such cases, the most common suggestions are:

- increase in premiums while maintaining the existing policy conditions,

- maintaining the amount of the premium, but changing the scope of the policy in accordance with the recommendations provided by the underwriter based on the history of events.

The role of artificial intelligence algorithms in this process could be supporting the work on constructing a new offer, by indicating what in a given policy would be best changed in order to minimize the risk for the insurance company while maintaining the most favorable offer from the customer’s point of view.

Summary

In this article I presented example use cases of artificial intelligence algorithms in the insurance industry. It is worth noting that, apart from the cases discussed, there are also others, such as: a chatbot serving customers, risk estimation, or fraud and scam detection.

These three examples can be not only applied in the insurance industry but also many others, such as the financial industry, as described with more detail in the article The use of AI in the financial industry.

If the topics discussed interest you please feel free to reach out through my profile on LI, as well as follow our entries on the Isolution blog and our company LI and FB profiles.

Katarzyna Roszczewska